We help organisations to Transact All types of Business

while fully adhering to Islamic banking principles.

while fully adhering to Islamic banking principles.

Islamic law prohibits usury, the collection and payment of profit – also commonly called riba in Islamic discourse. Islamic banking operates in accordance with the rules of Shariah, known as Fiqh al-Muamalat (Islamic rules on transactions). The basic principle of Islamic banking is the sharing of profit and loss and the prohibition of riba' (interest).

Ijarah is an effective and practical financing tool allowing businesses to acquire their equipment/machinery and individuals to acquire Home and Auto through leasing, instead of outright purchase, thus reducing the heavy burden of expenditure. A commonly used financing mode wherein the Bank (lessor) leases the property/goods to the customer (lessee) in return for a rental payment for a specified financing period. However liabilities of ownership are borne by lessor.

Murabaha is the most widespread mode of Islamic financing. It is also known as Mark up or Cost plus financing. It involves the purchase of goods by the bank as requested by its client. The goods are sold to the client with a pre-agreed mark-up. Repayment, usually in installments is specified in the contract. It is a financing technique used for Goods, Auto and Home finance.

Tawarruq is an extensively used Islamic financial product which allows clients to raise money quickly and easily, in theory without breaking Muslim bans on interest. A customer buys an easily saleable asset from an Islamic bank at a marked up price, to be paid at a later date, and quickly sells the asset to raise cash. The mark-up acts as a earning for the bank.

Istisna`a is the Islamic long-term construction finance option whereby a party undertakes to manufacture, build or construct assets, with an obligation from the manufacturer or producer to deliver them to the customer on completion. The key advantage of an istisna’ contract is that it can provide flexibility to the customer, where payments can be made in instalments linked to project completion, at delivery or after project completion.

Nucleus Software delivers world-class retail banking solutions to an ever-growing global customer base supporting multiple products, service lines, currencies and languages. This depth of global finance experience helps us deliver innovative banking solutions that create continuous value for our customers.

All banks and financial institutions are offering auto financing products with innovative service offerings and incentives to varied customer segments. Top automotive lenders focus their operations on managing risk exposure, scale to optimize processing efficiency and meeting the needs of their customers.

Personal loans, a category of unsecured loans, require robust credit evaluation processes to control the credit losses. Moreover, in view of the customer requirements, financial institutions want to disburse loans in the minimum possible time with requisite credit checks and without any errors.

The housing finance business is fraught with daily challenges for banks and financial institutions. Organizations need to adopt best credit evaluation practices to minimize the risks while extending credit to its customers. With today’s rapidly changing regulatory requirements

Symbiosis Neo suite for Education loan is a powerhouse of seamlessly integrated software modules, built with the objective of providing operational and decision-making support to all the business lines of banks and financial services companies.

Symbiosis Neo suite for Gold Loan provides seamlessly integrated software modules built with the objective of providing operational and decision-making support to the banks and financial institutions.

Symbiosis Neo for credit cards provides comprehensive support for the origination and delinquency management of a wide variety of credit card products. The solution is easily configurable, compatible with multiple channels and enables automation of credit card origination and processing.

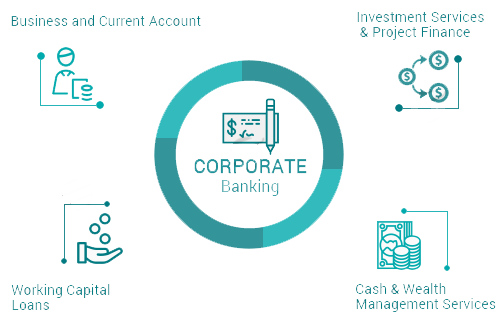

The banking market is being reshaped by the shifts in the economic landscape, changing customer demand and the desire for new business models. Success in corporate banking is all about developing strong, mutually beneficial customer relationships which can grow into long-term partnerships.